Mortgage News

By: Matthew Graham

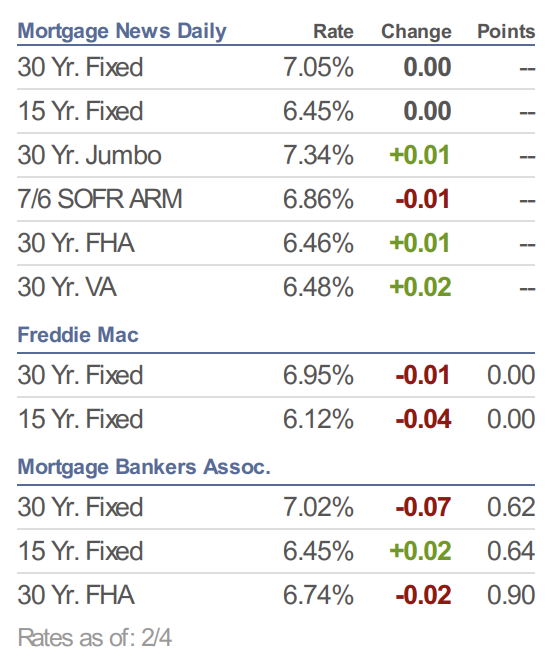

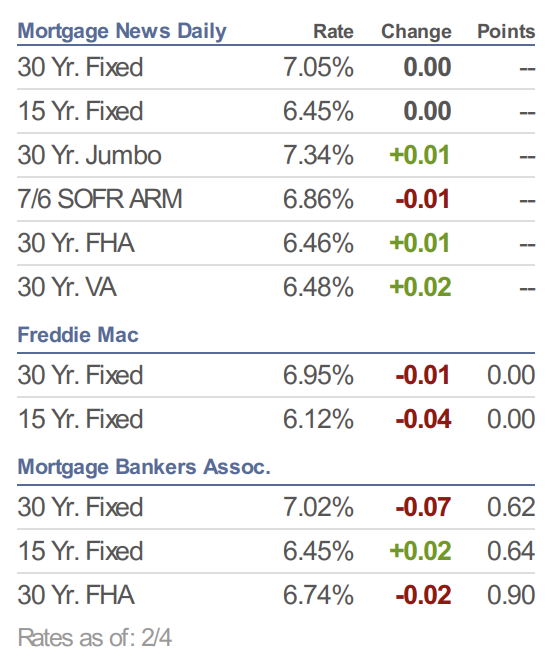

If you like your mortgage rate movement boring and minimal, this week's for you (and last week, and the week before that). Going all the way back to January 17th, the average lender hasn't changed their top tier 30yr fixed rate quote by more than 0.05%, and has been operating in an overall range of 0.07%.

To get an idea of how narrow that is, a typical highly volatile day involves rates moving by more than .12%. In stark contrast, the average rate hasn't changed by even 0.01% since last Thursday.

This stability isn't for lack of apparent inspiration for volatility. Clearly, there are plenty of political developments in the first month of any new presidential administration. Those developments have indeed translated to small scale, in-range volatility in the markets that determine interest rates, but they've largely canceled each other out, or been canceled out by other events.

Despite the calm, we wouldn't advocate a complacent attitude looking forward. Rates can still be impacted by economic data and the next 6 business days bring the heaviest hitting reports of the month (chiefly Friday's jobs report and next Wednesday's Consumer Price Index).

By: Matthew Graham

If you like your mortgage rate movement boring and minimal, this week's for you (and last week, and the week before that). Going all the way back to January 17th, the average lender hasn't changed their top tier 30yr fixed rate quote by more than 0.05%, and has been operating in an overall range of 0.07%.

To get an idea of how narrow that is, a typical highly volatile day involves rates moving by more than .12%. In stark contrast, the average rate hasn't changed by even 0.01% since last Thursday.

This stability isn't for lack of apparent inspiration for volatility. Clearly, there are plenty of political developments in the first month of any new presidential administration. Those developments have indeed translated to small scale, in-range volatility in the markets that determine interest rates, but they've largely canceled each other out, or been canceled out by other events.

Despite the calm, we wouldn't advocate a complacent attitude looking forward. Rates can still be impacted by economic data and the next 6 business days bring the heaviest hitting reports of the month (chiefly Friday's jobs report and next Wednesday's Consumer Price Index).

My top 5 things to do in February!

1. Black History Month Events! A list of all the events happening in West Michigan this month!

2. Galentine's Events! Single and not ready to Mingle? That's ok! Here's a list of events just for you

3. Valentine's Date Night Ideas & Events! Looking to impress that special someone? Here's a list of all that happening to help you spark romance.

4. Grand Rapids Boat Show! -February 12-16 At DeVos! Get excited for summer adventures!

5. West Michigan Home and Garden Show! -February 27- March 2

Putting the 'Tea' in Realty

Anyone looking to sell or buy this year is facing the difficulty of knowing if and when it will be the best time. Buyers are hoping to save money by finding a home before the spring market hits (hint: it's already here), but are faced with interest rates hovering right at 7%. Sellers are not wanting to give up their drool-worthy 3% interest rates in exchange for higher rates and higher priced homes. It seems we are at a stale-mate of sorts with parties playing chicken. Even rentals are having a hard time getting filled as people find ways to save money by moving in with family.

Meanwhile, agents, lenders, and state reps are trying to find ways to create more affordable housing as quickly as possible. While this stalemate will seem to last through summer, I have confidence that great homes are still available from those who need to move.