Sarah, you are crazy. Why would you say that?!

Scoff if you must, but here's the truth. We are still in a housing shortage. According to the Housing Next housing needs assessment conducted in 2022, by 2027, Kent County needs an additional 35,000 units, whether rental or for-sale. Ottawa County needs an addition 15,000 and Muskegon County needs another 3,000. Over that 5 year period, that's 223 NEW builds each week since 2022. I haven't observed that. Have you?

We are in a housing shortage for the foreseeable future, and that's why interest rates are good for buyers. With higher interest rates, the investors who need to use equity forward from other houses are thinking twice about loans (which come at an even higher rate on 2nd properties), keeping them from outbidding. It's making buyers who weren't as strong in the financing and pre-approvals and the ones we agents look at and wonder if they're ready to buy a house and try to educate as much as we can in hopes that they understand the repairs and upkeep needed.

The buyers who are left during this interest rate upturn are those that are still serious about moving, the ones with solid credit that come in a little under the current rate with their credit scores and buy-down abilities, and the ones who have been patient while getting out-bid on homes that might have been over-sold.

We are in a temporary buyer's market. This won't last once the interest rates start drifting down. We saw a hint of it 2 weeks ago. The interest rates brushed 5% and a week later buyers came back out of their pause and started bidding. As soon as it hit 7% again, they all froze. But for the buyers that are savvy, this is why it's ok to keep looking.

Right now, homes are selling at or below value. Seller's are almost forced to make repairs, pay for closing costs, and cover the buyer agency fee or lose the deal. However, that hint at 5% tells me if rates get to that point, we are going to see a madhouse, potentially close to what we say in 2022.

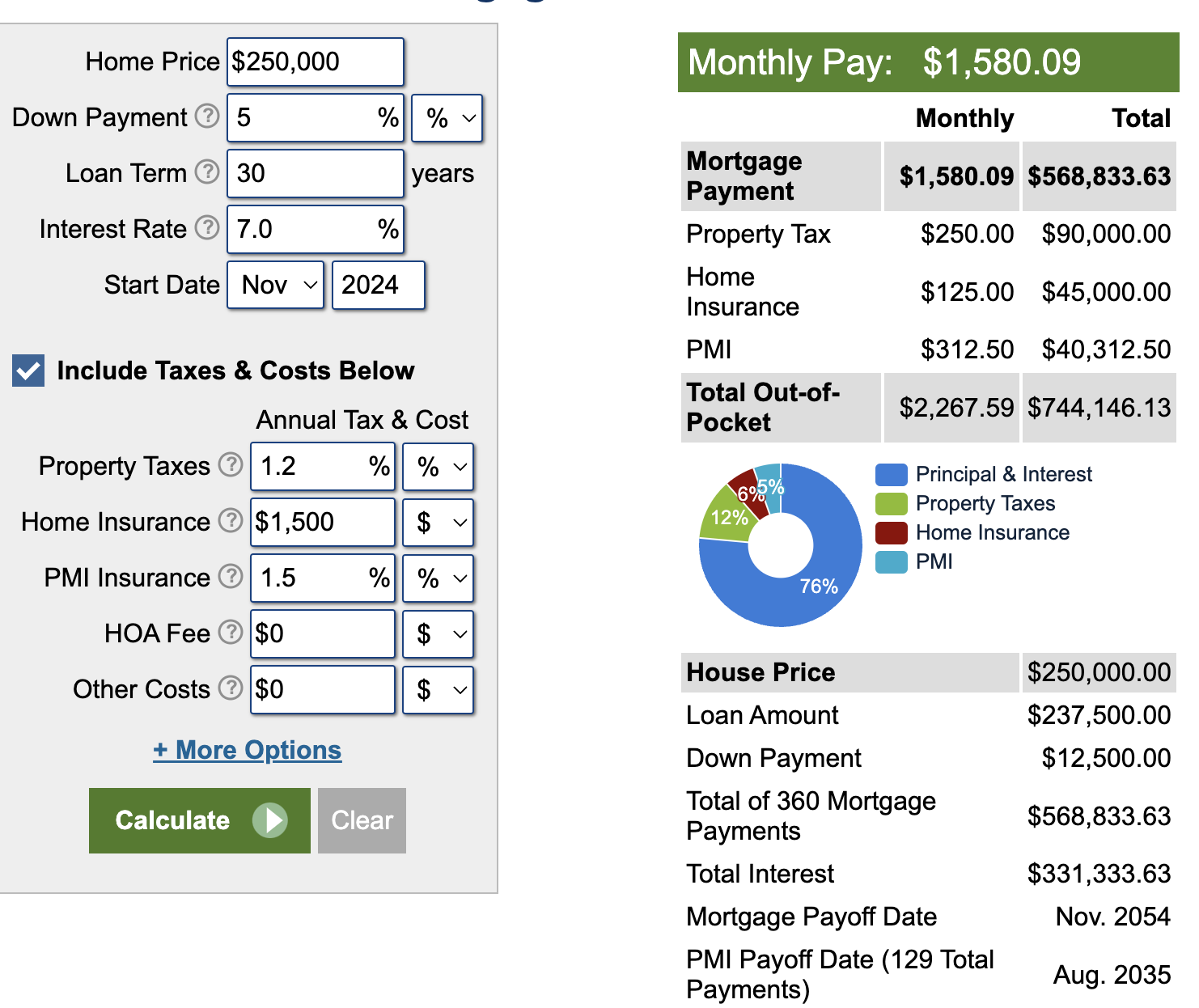

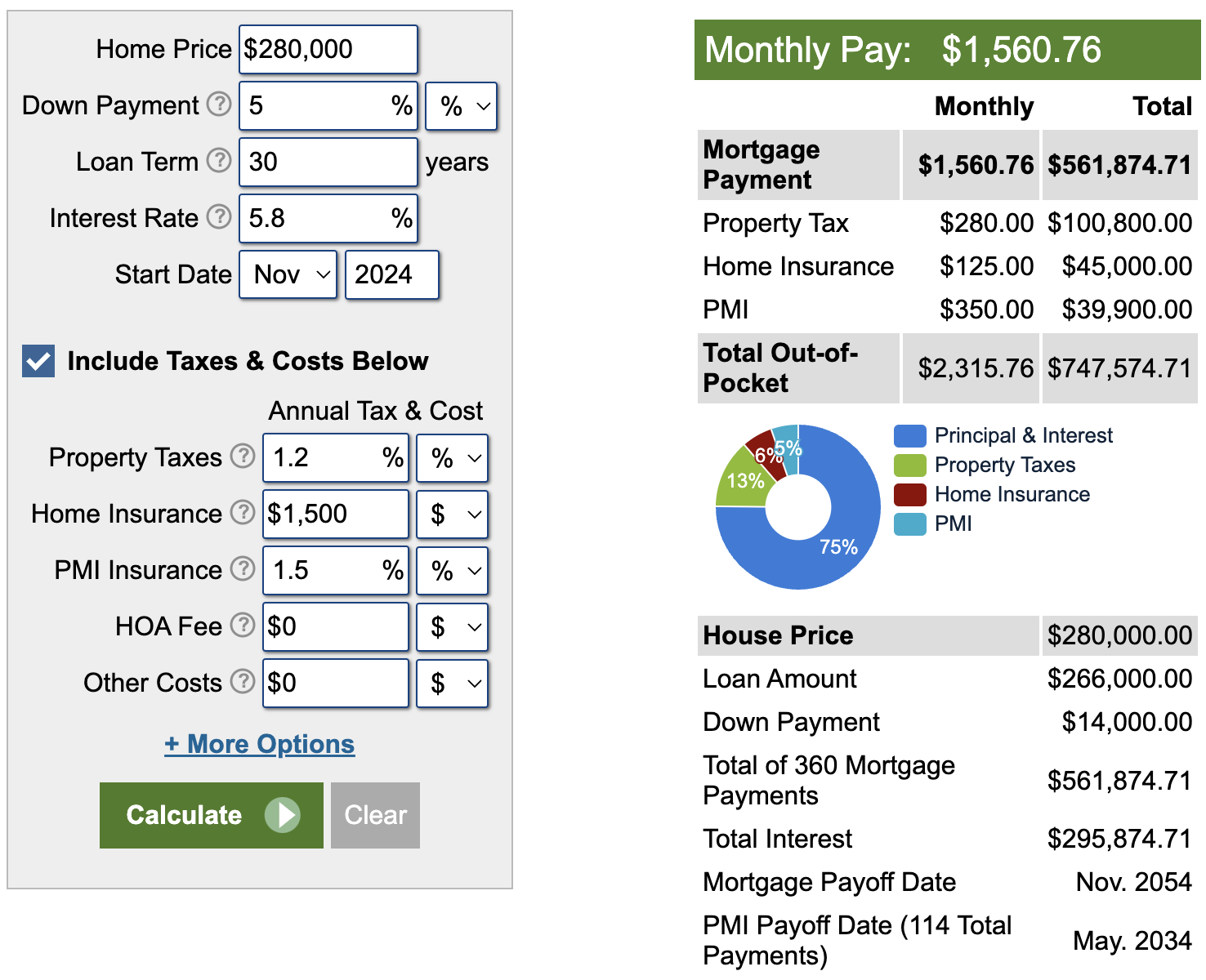

I would rather see my clients get a home for list price at 250k with a 7% interest rate that they can refinance later to drop the rate and the payment, than compete and pay 280k for that same home at a 5.8% rate. Why? Let's run the amortization schedule:

Estimated monthly payment for a $250k home at 7% is $2267.59

Estimated monthly payment for a $280k home at 5.8% is $2315.76. Buyers waiting to compete, to spend more on a home just to 'save' on the interest rate is NUTS! Sure, it's only a $50 savings month-to-month, but that first year, at the higher interest rate you've now saved $600. That could be what you need to cover the tax increase that comes the following year upon buying a house. Not just that, the buyers who waited are again competing against appraisal gaps, no inspections and no repairs.

Let's look at what a refinance does for the first one. The second one isn't within range for a refinance. I don't foresee rates going below 5% in the next 10 years, so that home will not be refinanced until there is some equity gain and it makes sense to do so.

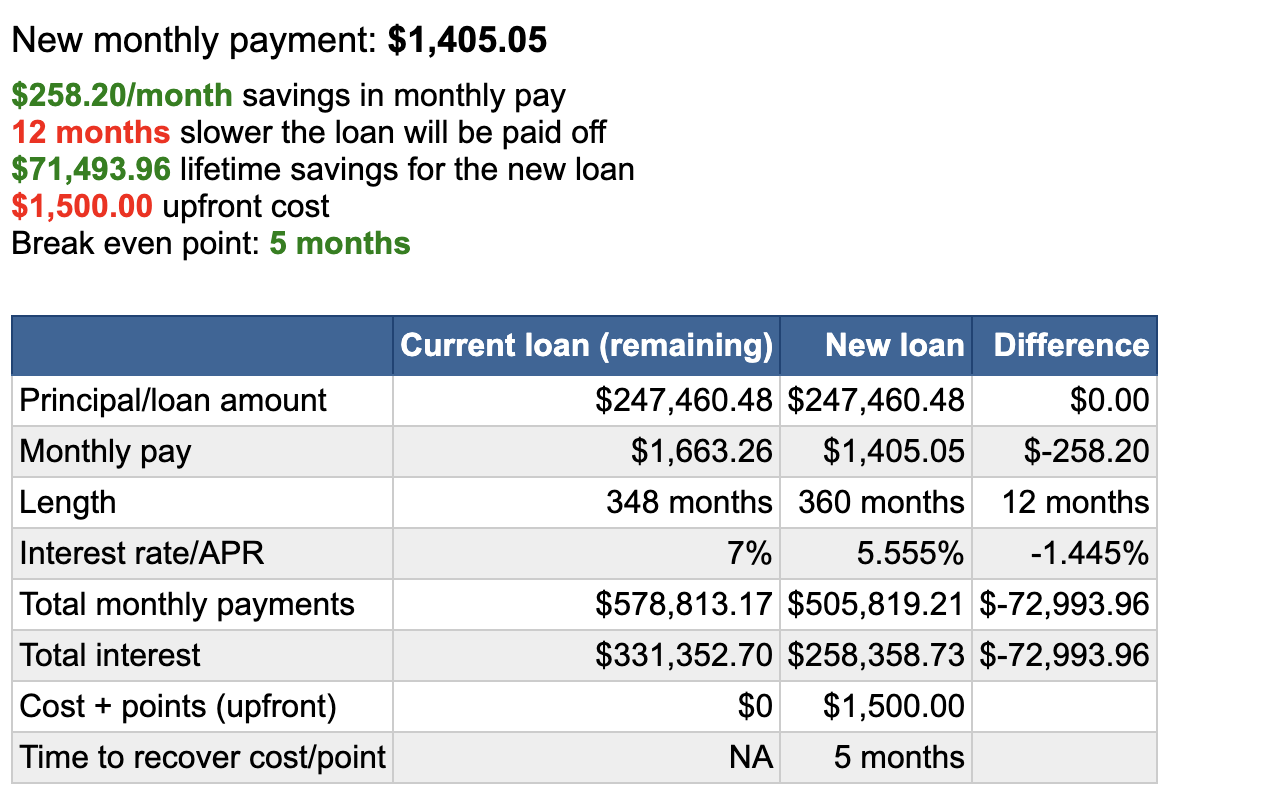

Let's say interest rates get to 5.5% a year after the first buyer who bought now at the lower price and they wanted to refinance. Let's look at what their payment would be:

We need to add back in the taxes and insurance ($687.50), so the total monthly payment would be: $2092.55.

Not only do they owe less on their home that has now gained equitable value and will drop it's PMI faster, They are paying $370 LESS than the buyer who chose to rate for the interest rates.

Moral of the story? The higher interest rates are good for buyers so let's get out there now!

If you're looking for products to help you determine your financial abilities, Calculator.net has some great ones!